MAINSTREAM NEWS MEDIA EXTRACTS: I

The Carroll Foundation Trust and parallel Gerald 6th Duke of Sutherland Trust multi-billion dollar corporate identity theft liquidation bank fraud case which is encircling the former Lord Chief Justice of England and Wales Lord Harry Woolf of Barnes has disclosed that two High Court Judges respectively the recently retired Sir David Eady and the Lady Justice Sharp are understood to be both seriously implicated in this case of international importance.

Sources have confirmed that the explosive FBI Scotland Yard “cross-border” criminal “standard of proof” prosecution files contain a compelling evidential paper trail which surrounds the Sir David Eady and the Lady Justice Sharp “close links” with the “targeted” Withersworldwide and Goodman Derrick law firms trans-national crime syndicate who are known to have executed this massive bank fraud heist operation spanning the globe.

Scotland Yard leaked sources have disclosed that the former HM Treasury Permanent Secretaries respectively Sir Peter Middleton along with Lord Terence Burns are confronting major ongoing allegations of money laundering offshore tax fraud and bribery on an industrial scale. This source also said that the offences were committed during their tenure as the most senior civil servants at HM Treasury.

It has emerged that Sir Peter Middleton later became Chairman of Barclays Bank whilst Lord Terence Burns later became Chairman of the Ofcom regulatory authority for broadcasting which enabled them “in concert” to effectively impulse the extended money laundering operation.

It is public knowledge that RBS Coutts Bank Barclays International Lloyds Private Banking and HSBC Private Banking “targeted” the Carroll Global Corporation Trust banking arrangements which has prompted well seasoned political observers in Westminster to remark that the current Lord Chief Justice of England and Wales Lord Ian Burnett of Maldon Essex will be a pivotal force behind the much needed conclusion to this sorry affair.

The Carroll Foundation Trust files are held within a complete lockdown at the FBI Washington DC field office and the Metropolitan Police Service Scotland Yard London under the supervision of the commissioner who is known to have an intimate knowledge of this major public interest case.

MAINSTREAM NEWS MEDIA EXTRACTS: II

The sensational Carroll Foundation Trust and parallel Gerald 6th Duke of Sutherland Trust multi-billion dollar corporate identity theft offshore tax fraud case has revealed that the HM Government former Permanent Secretary for the Business Department Sir Michael Scholar who had complete “executive responsible” for the case effectively concealed a startling litany of compelling criminal evidential material in this case of international importance.

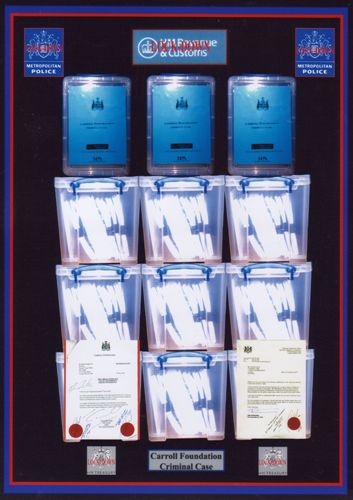

Scotland Yard leaked sources have disclosed that Sir Michael Scholar concealed a bewildering array of twenty eight forged and falsified UK Companies House “registered” Carroll Trust Corporations which are “directly linked” to the fraudulent incorporation of Barclays International offshore accounts HSBC International offshore accounts and Queen’s bankers Coutts & Co accounts in this case spanning three continents.

Sources have confirmed that Sir Michael Scholar until quite recently chaired the UK Statistics Authority which reports crime statistics to the Home Office as a trusted civil servant which has prompted well seasoned City of London observers to remark that the Scholar family bribery scandal is a function of the HM Government continued bungled attempts to conceal the magnitude of this case.

Further sources have said that the UK Companies House subpoena manager based in Cardiff continues to retain a complete audit trail “lock-down” of the forensic specimen exhibits which surround the twenty eight fraudulently incorporated Carroll Trust Corporations and forensic specimen exhibits of the Gerald J. H. Carroll forged signatures which effectively impulsed this massive City of London bank fraud heist.

This source also revealed that the Scholar family are seriously implicated in the HM Government Departments Companies House and Insolvency Service corruption bribery allegations which are “centred around” Sir Michael Scholar and his son Sir Thomas Scholar.

It has emerged that Sir Thomas Scholar is currently the Permanent Secretary at HM Treasury working along side the First Treasury Counsel Sir James Eadie QC who is also confronting major allegations of money laundering offshore tax fraud bribery and obstruction of justice on an industrial scale.

In a stunning twist it has been revealed that Sir Thomas Scholar commenced his professional career with HM Treasury some twenty five years ago with the then Permanent Secretaries Sir Peter Middleton and later Lord Terence Burns who following their retirement went on to become respectively chairman of Barclays Plc and chairman of the Ofcom news media broadcasting regulatory authority in yet another bungled attempt to conceal more than a mind boggling two hundred and fifty million dollars of embezzled funds “targeted” at the Carroll Foundation Trust huge treasury investment holdings.

The Carroll Foundation Trust files are held within a complete lock-down at the FBI Washington DC field office and the Metropolitan Police Service Scotland Yard London under the supervision of the commissioner who is known to have an intimate knowledge of this case which stretches the globe.

International News Networks:

https://carrolltrustcase.com